How to claim up to $100,000 on implementing Myfreight

The 2022-23 Federal Budget provided an allocation of up to $1.6 billion in tax relief for digital adoption through the ‘Small Business Technology Investment Boost’. This boost incentivises small businesses to go digital and upskill their employees and is in place until 30 June 2024.

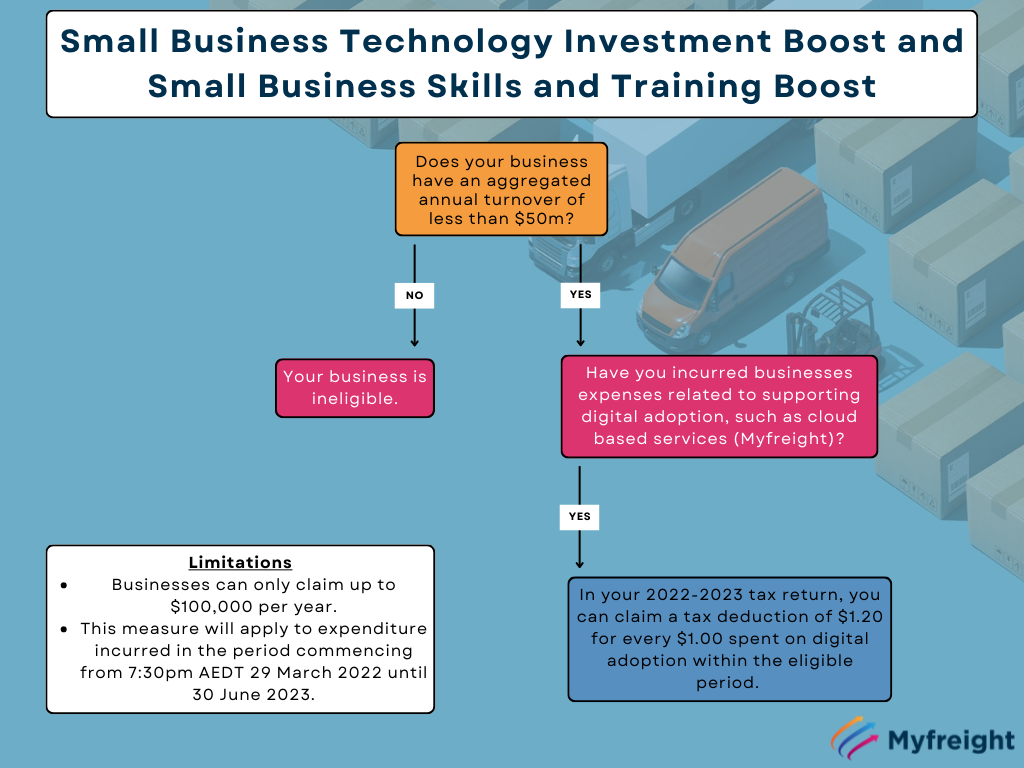

The then Government announced to support businesses with an aggregated annual turnover of less than $50 million. Businesses can claim a $1.20 deduction on every $1.00 spent on depreciating assets that support digital adoption (including Myfreight) with an annual cap of $100,000.

We are still waiting for the legislation to be passed which will give more specifics, however the diagram below outlines whether your business is eligible for the boost.

Further information can be found on the Australian Tax Office website here:

Please note, that the above blog post is Myfreight’s interpretation of information provided on the Australian Taxation Office’s website, last updated September 6th, 2022. At the time of publication, the information published on the Australian Taxation Office website which has been referenced in this post is not yet law and is subject to decisions from the new Government. Myfreight would encourage our customers to seek advice from a registered tax agent if they have any questions regarding the Small Business Technology Investment Boost.

To find out more, contact the team at Myfreight by visiting the Contact Us page on our website.